UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] | Definitive Proxy Statement |

| [X] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to Section 240.14a-12 |

ANDINA ACQUISITION CORP. III

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No. | |

| (3) | Filing Party: | |

| (4) | Date Filed: |

ANDINA

ACQUISITION CORP. III

Calle 113 #7-45 Torre B, Oficina 1012

Bogotá, Colombia

ADDITIONAL INFORMATION REGARDING THE SPECIAL MEETING OF

SHAREHOLDERS TO BE HELD ON JULY 29, 2020

The following information in the form of a press release and an investor presentation supplements and relates to the proxy statement (the “Extension Proxy Statement”) that was mailed by Andina Acquisition Corp. III (“Andina” or the “Company”) to its shareholders in connection with Andina’s Extraordinary General Meeting of Shareholders to be held on July 29, 2020 to approve an extension of time in which Andina must complete its initial business combination or liquidate the trust account that holds the proceeds of the Company’s initial public offering (the “Extension”). This supplement is being filed with the SEC and is being made available to shareholders on or about July 22, 2020. This supplement should be read in conjunction with the Extension Proxy Statement filed with the U.S. Securities and Exchange Commission (“SEC”) and furnished to shareholders on or about July 7, 2020.

Andina Acquisition Corp. III and EMMAC Life Sciences Limited Announce Signing of Non-Binding Letter of Intent for Business Combination

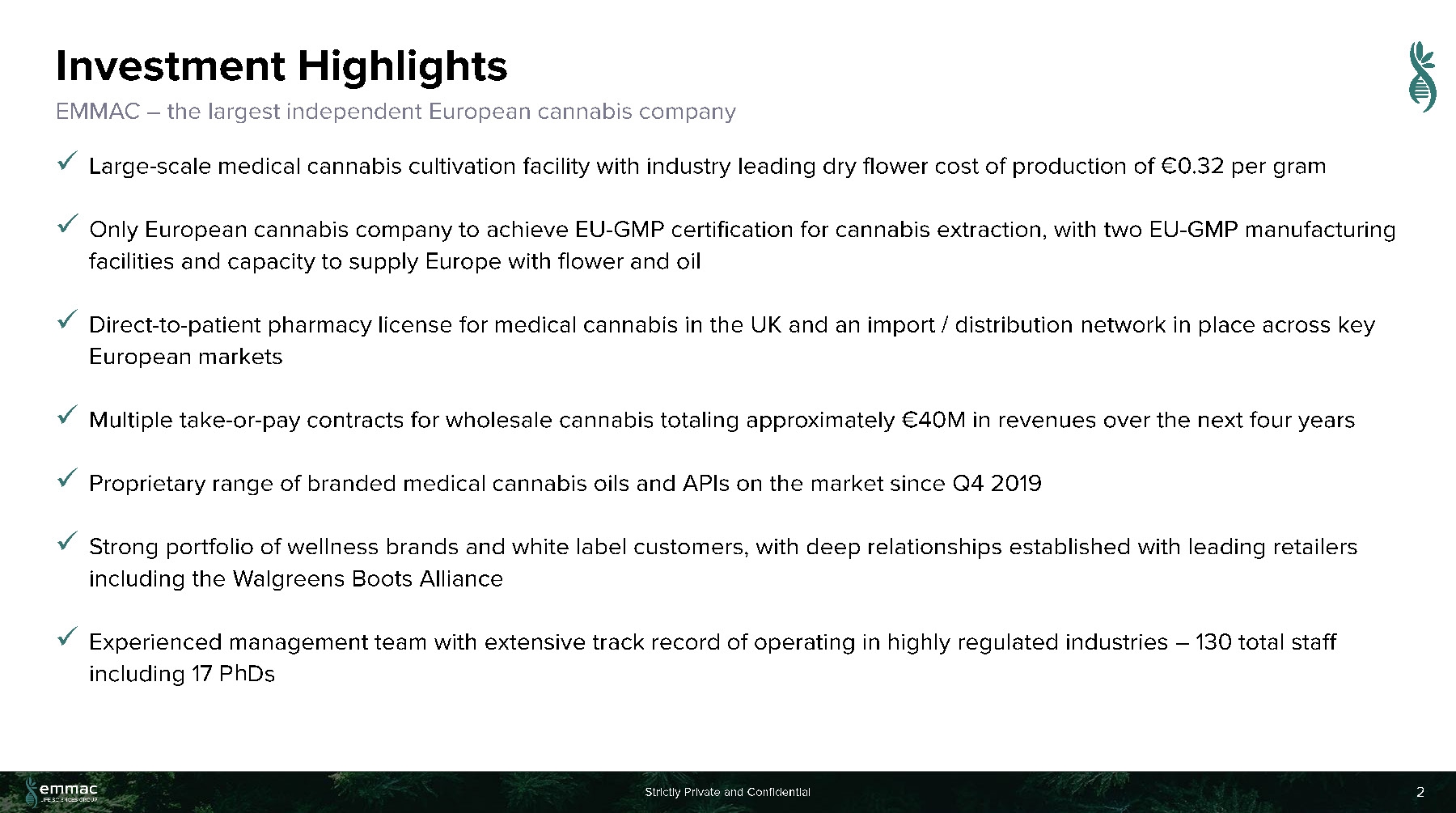

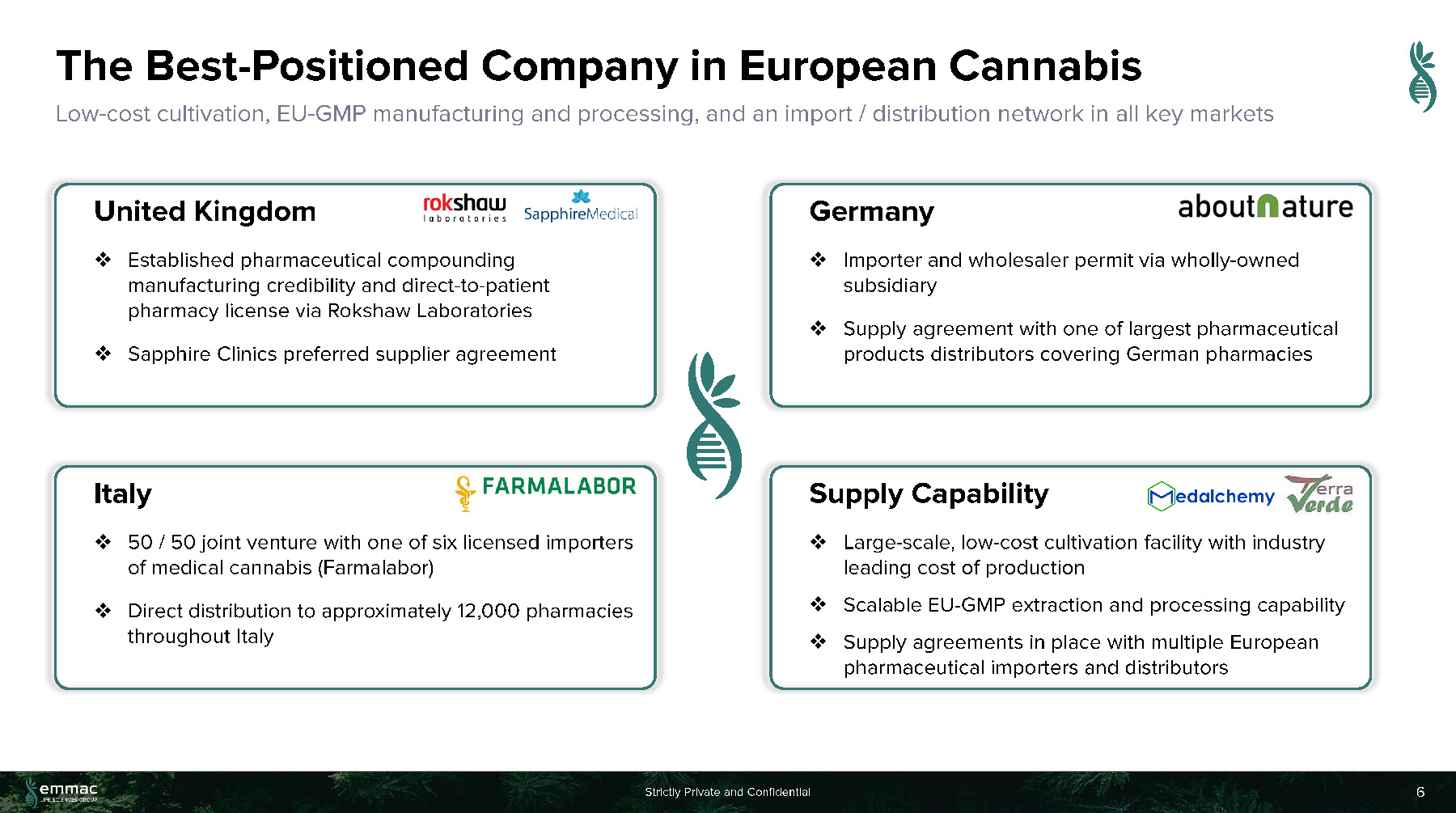

EMMAC is the Largest Independent European Cannabis Company with Low-Cost Cultivation, EU-GMP Manufacturing and Processing, and an Import / Distribution Network in all Key European Markets

New York, NY and London, UK – July 22, 2020 - Andina Acquisition Corp. III (NASDAQ: ANDA, ANDAW, and ANDAU) (“Andina”) and EMMAC Life Sciences Limited (“EMMAC”) jointly announced today that they have signed a non-binding letter of intent (the “LOI”) relating to a business combination, pursuant to which EMMAC would become a publicly traded company on the NASDAQ Stock Market with EMMAC’s shareholders rolling over all of their equity in EMMAC into the combined public company. As consideration for the transaction, it is anticipated that the current EMMAC shareholders would collectively own a majority of the equity of the combined public company.

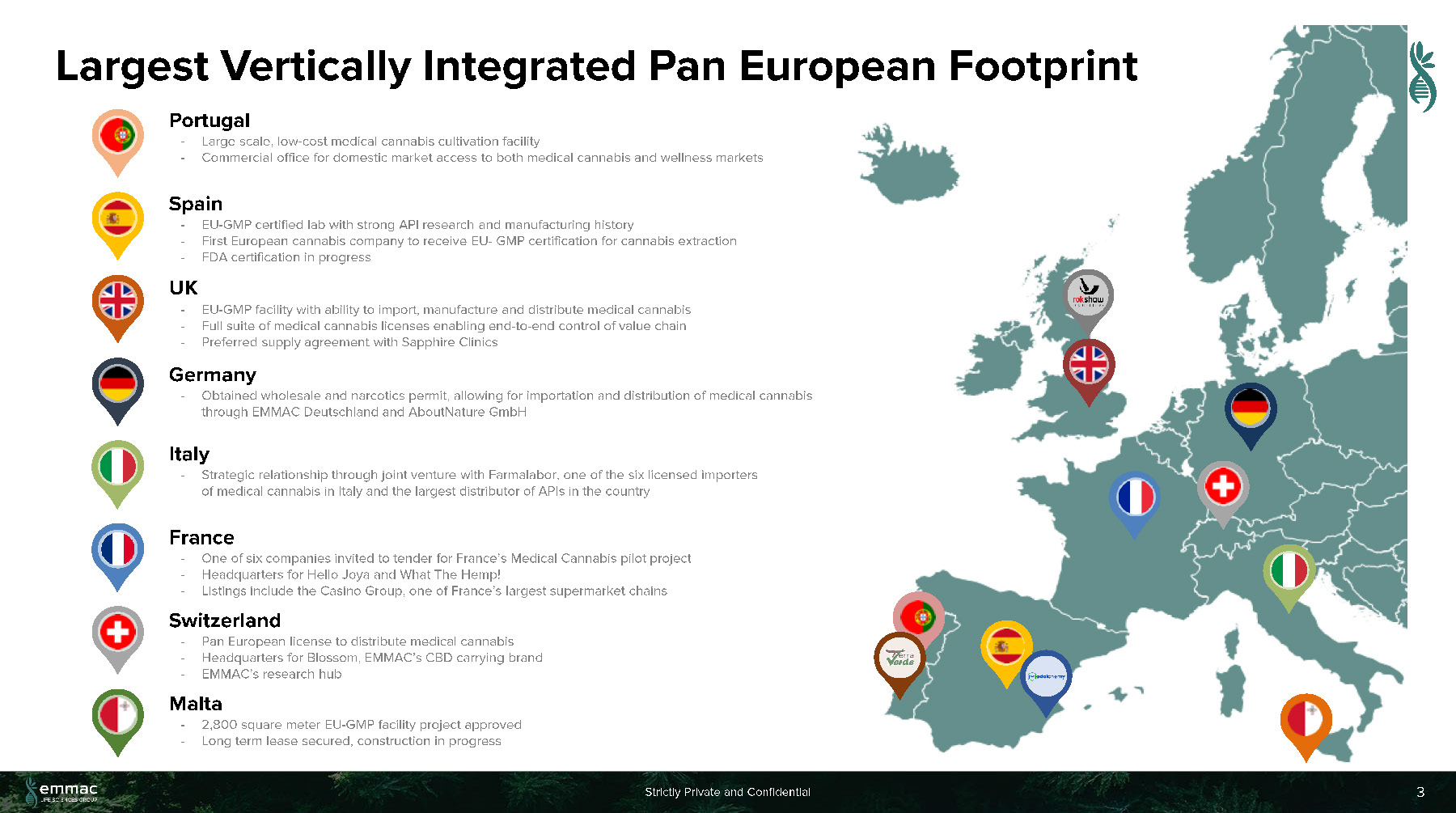

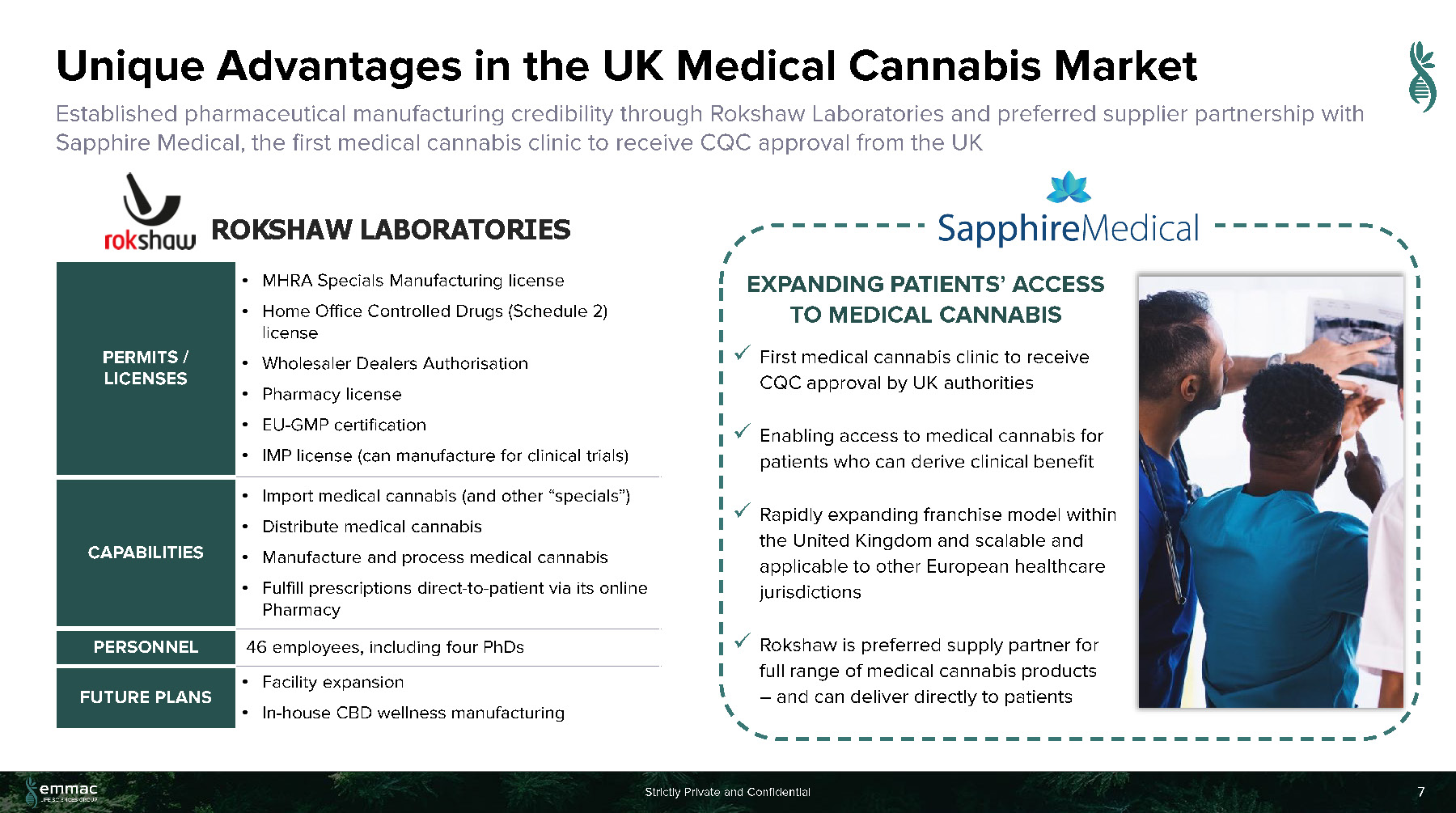

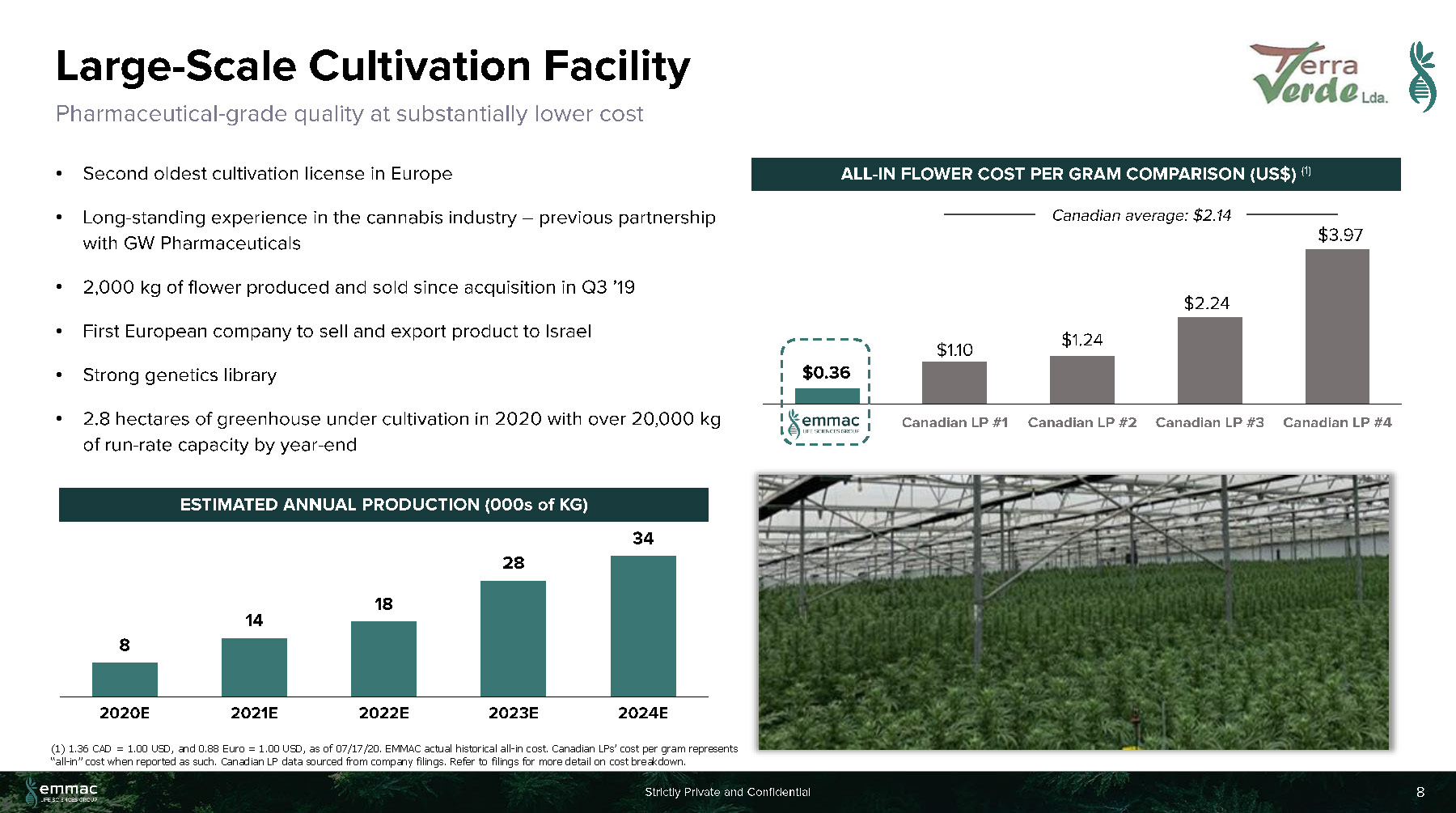

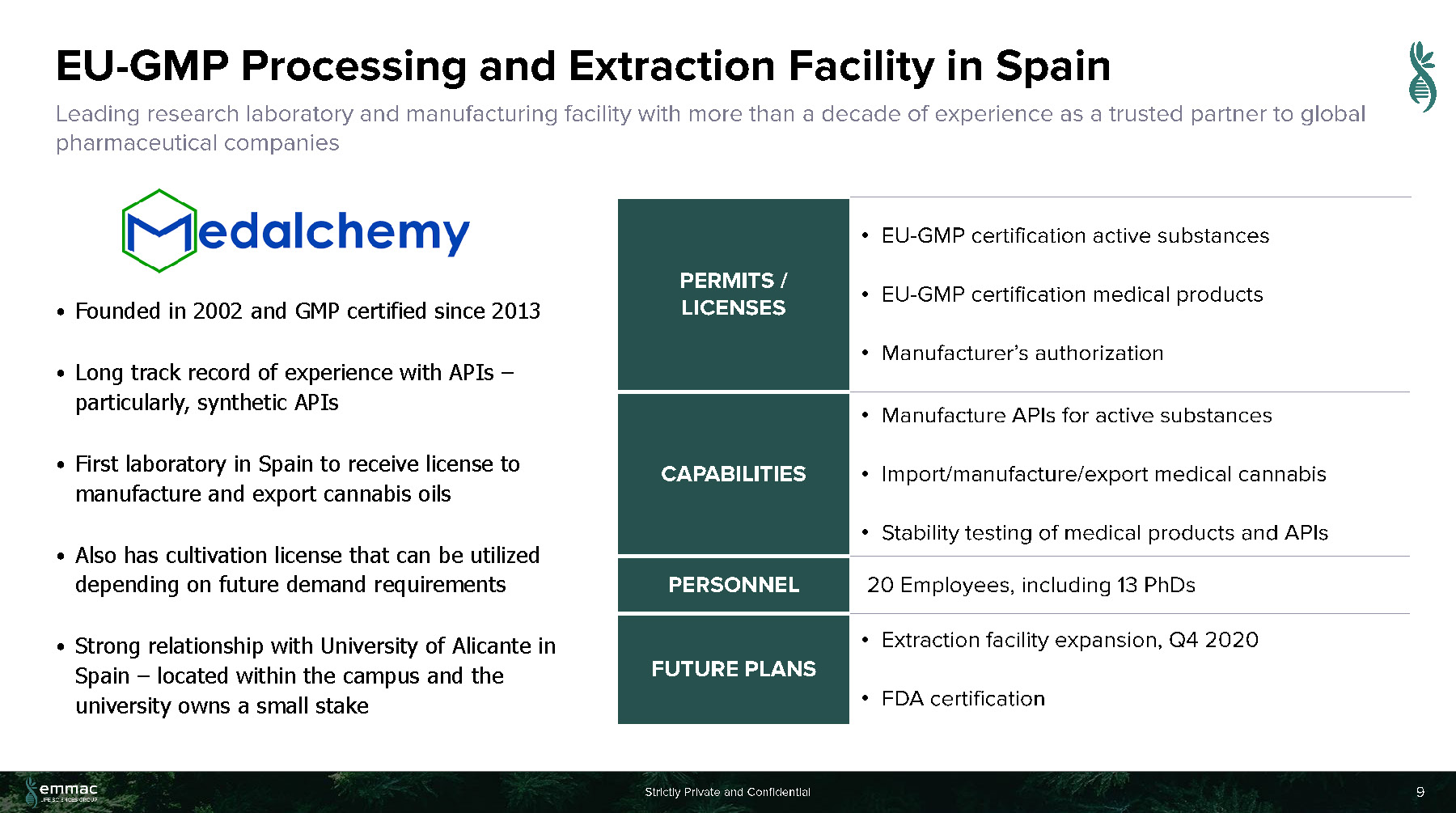

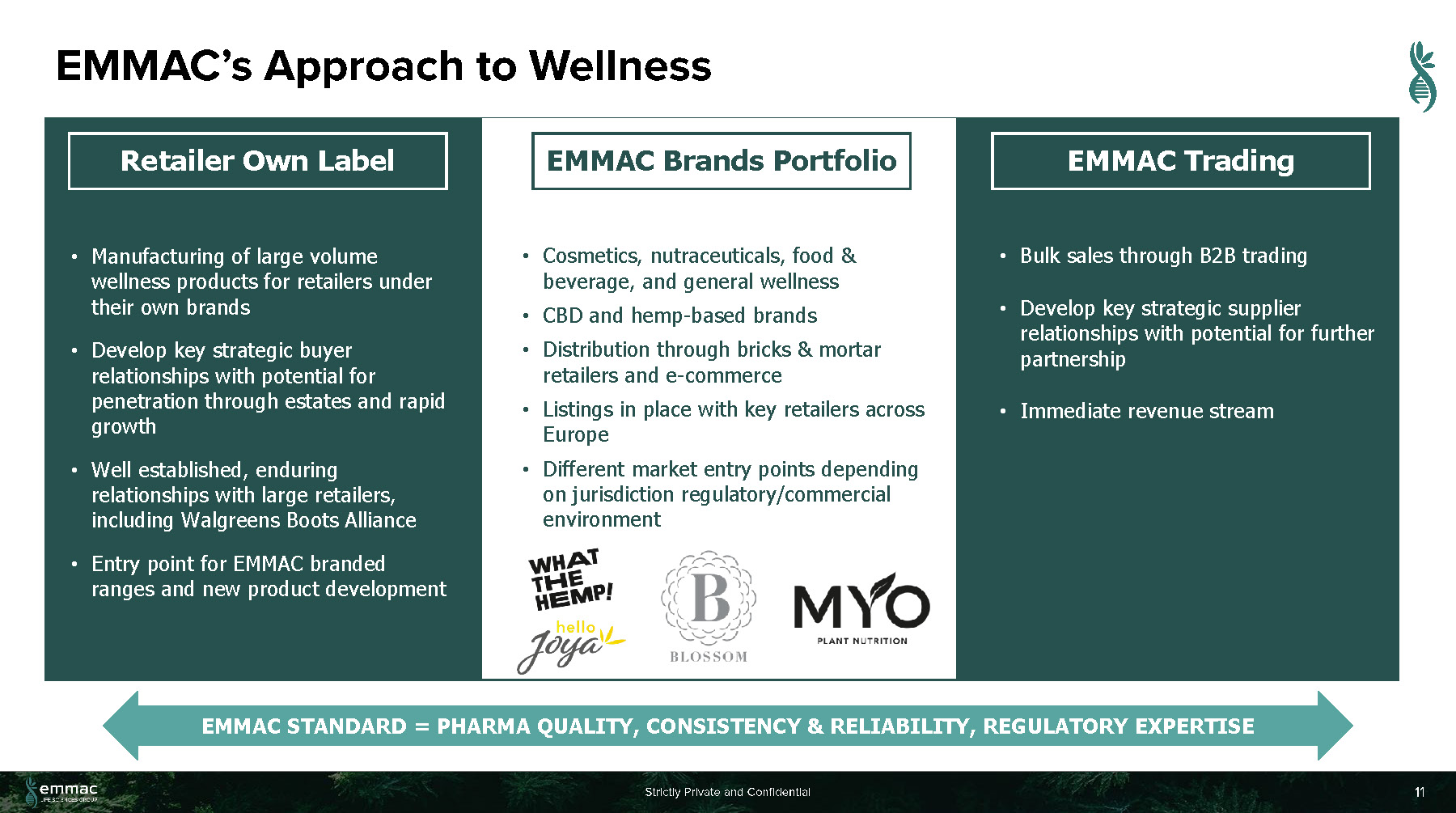

EMMAC is Europe’s largest independent cannabis company, bringing together cutting-edge scientific research with the latest innovations in medical cannabis cultivation, extraction and production. The company is a trusted cannabis partner for the medical and wellness communities and leader in the production and supply of medical cannabis, wellness CBD, hemp, and other derivative products with large scale, low-cost, cultivation, EU-GMP manufacturing and processing, import / distribution network across all critical European markets. EMMAC has established pharmaceutical and medical cannabis manufacturing credibility and a direct-to-patient pharmacy license, multiple take-or-pay contracts for wholesale cannabis, and a strong portfolio of wellness brands and wellness products. EMMAC is also the first European cannabis company to sell and export product to Israel and will be launching white-label CBD products in the US.

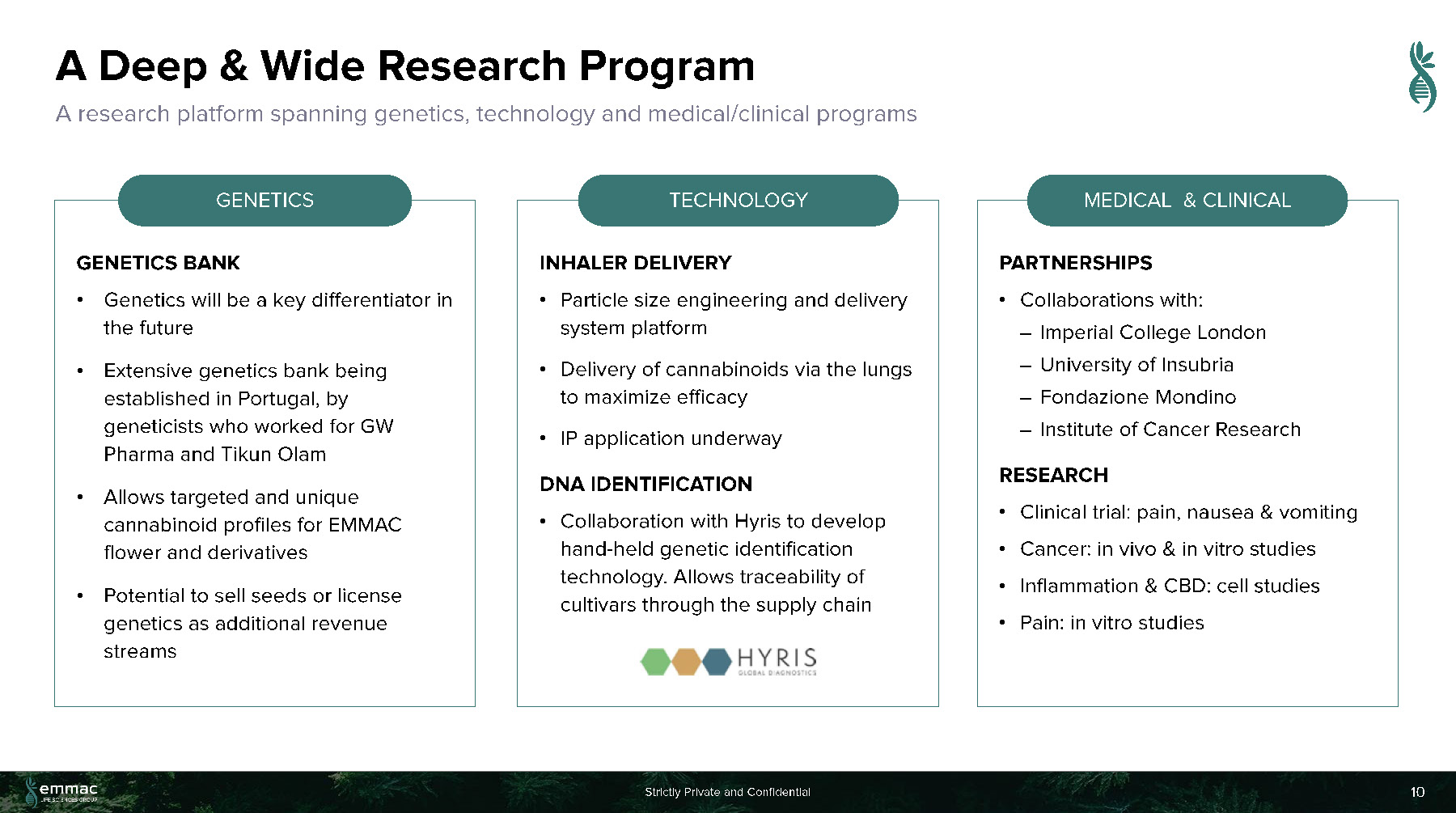

EMMAC has an extensive research platform spanning genetics, technology, and medical/clinical programs with Imperial College London and other leading European research centers. EMMAC’s wealth of experience, combined with a network of supply and distribution partnerships throughout Europe, mean that it is uniquely positioned to meet the rapidly growing demands of the market, led by regulatory change and the increasing demand for access to premium quality cannabis product.

Additional information on EMMAC can be found in an investor presentation that has been furnished by Andina to the SEC as an exhibit to a Current Report on Form 8-K, which can also be found on Andina’s website at http://www.andinaacquisition.com/ or on EMMAC’s website at https://www.emmac.com/

As contemplated by the LOI, EMMAC’s executive team, led by Chairman Lorne Abony, CEO Antonio Costanzo, CFO Thomas Ellen, and COO Tom Rooke, would continue leading the combined company. These executives and their management team have extensive experience operating in highly regulated industries across key sectors. In total, EMMAC has approximately 130 employees, including 17 Ph.D’s.

Completion of the business combination is subject to, among other matters, the completion of due diligence, the negotiation and execution of a definitive agreement for the business combination, satisfaction of the conditions negotiated therein and approval of the transaction by Andina stockholders. Accordingly, there can be no assurance that a definitive agreement will be entered into or the proposed transaction will be consummated on the terms or timeframe currently contemplated, or at all. Any transaction would be subject to the approval of the two companies’ boards and shareholder approvals, as well as other customary conditions.

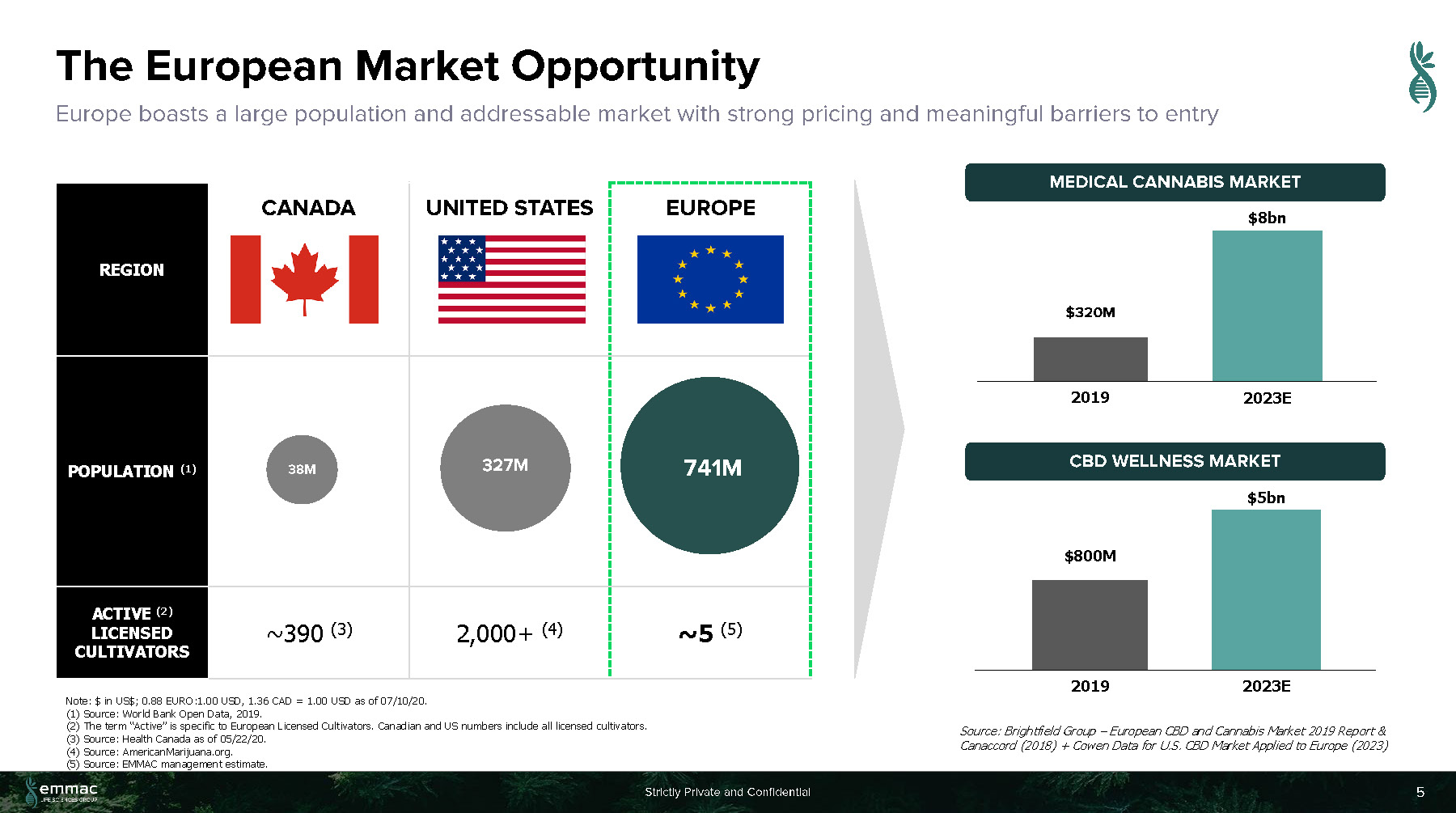

Luke Weil, Chairman of Andina, and Julio A. Torres, CEO of Andina, said, “As the largest independent European cannabis company, we believe that EMMAC is an extremely attractive investment opportunity and would be a tremendous merger partner for Andina. Given Europe’s large population, addressable market with strong pricing, and meaningful barriers to entry, EMMAC’s vertically-integrated pan European footprint ideally position the company to realize significant opportunities in both medical cannabis and CBD wellness. By 2023, these markets are estimated to reach $8 billion and $5 billion, respectively, according to industry research (1). We are looking forward to partnering with EMMAC’s world-class team and supporting them as they continue their expansion and enter this new phase as a public company.”

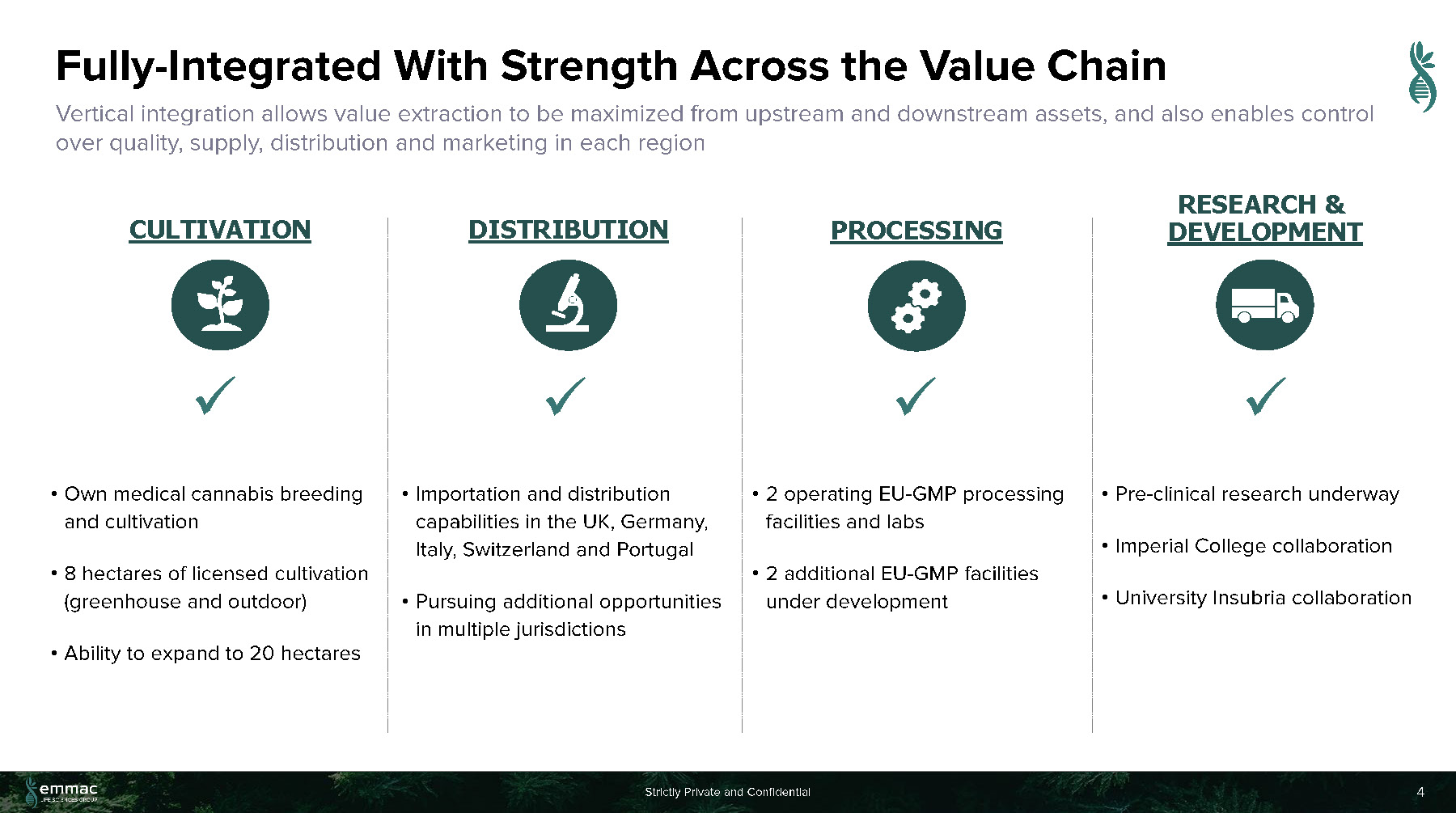

Lorne Abony, Executive Chairman of EMMAC, and Antonio Costanzo, CEO of EMMAC, said, “The Andina team possesses significant experience assisting companies like ours and will add significant value to us as a strategic partner. As a fully-integrated company with strength across the value chain, we are proud of what EMMAC has already accomplished in maximizing value from upstream and downstream assets, while controlling quality, supply, distribution and marketing in each region. Our executive team is eager to begin work with Andina as we continue to aggressively pursue opportunities within the European cannabis market.”

Cowen is serving as financial and capital markets advisor to Andina and Ellenoff Grossman & Schole LLP is serving as legal advisor to Andina. Stifel is serving as financial advisor to EMMAC. Winston & Strawn LLP is serving as legal advisor to EMMAC.

| 1) | Brightfield Group – European CBD and Cannabis Market 2019 Report & Canaccord (2018) + Cowen Data for U.S. CBD Market Applied to Europe (2023) |

About Andina Acquisition Corp. III

Andina Acquisition Corp. III (NASDAQ: ANDA, ANDAW, and ANDAU) is a blank check company for the purpose of entering into a merger, share exchange, asset acquisition, share purchase, recapitalization, reorganization or similar business combination with one or more businesses or entities. For information about Andina, please visit http://www.andinaacquisition.com/

About EMMAC Life Sciences Limited

EMMAC Life Sciences Limited is Europe’s largest independent cannabis company, bringing together pioneering science and research with cutting-edge cultivation, extraction and production. With a unique supply and distribution network throughout Europe, EMMAC’s vision is to bring the life-enhancing potential of cannabis to the people who need it. For more information about EMMAC, please visit https://www.emmac.com/

Additional Information and Where to Find It

If a definitive agreement is entered into and in connection with the proposed transactions described herein, a full description of the terms of the transaction will be provided in a proxy statement/prospectus for Andina’s stockholders to be filed with the U.S. Securities and Exchange Commission (the “SEC”). Andina urges investors, stockholders and other interested persons to read, when available, the preliminary proxy statement/prospectus, as well as other documents filed with the SEC, because these documents will contain important information about the Company, EMMAC and the proposed business combination transaction. The definitive proxy statement/prospectus will be mailed to stockholders of Andina as of a record date to be established for voting on the proposed transaction. Shareholders may obtain copies of the proxy statement/prospectus, when available, without charge, at the SEC’s website at www.sec.gov or by directing a request to: Andina Acquisition Corp. III, Calle 113 #7-45 Torre B, Oficinia 1012, Bogota, Colombia.

In addition, Andina has filed a definitive proxy statement (the “Extension Proxy Statement”) to be use at its special meeting of shareholders to approve an extension of time in which Andina must complete its initial business combination or liquidate the trust account that holds the proceeds of the Company’s initial public offering (the “Extension”). Andina mailed the Extension Proxy Statement and other relevant documents to its shareholders of record as of July 1, 2020 in connection with the Extension. Investors and security holders of Andina are advised to read the Extension Proxy Statement because this document contains important information about the Extension. Shareholders are able to obtain copies of the Extension Proxy Statement, without charge, at the SEC’s website at www.sec.gov or by directing a request to: Andina Acquisition Corp. III, Calle 113 #7-45 Torre B, Oficinia 1012, Bogota, Colombia.

Participants in Solicitation

Andina and its directors, executive officers and other members of their management and employees may be deemed to be participants in the solicitation of proxies of Andina stockholders in connection with the Extension and the potential transaction described herein under the rules of the SEC. Investors and security holders may obtain more detailed information regarding the names, affiliations and interests of Andina’s directors in the Extension Proxy Statement, which was filed with the SEC on July 6, 2020 and will also be contained in the proxy statement/prospectus relating to the proposed transaction when it is filed with the SEC. These documents may be obtained free of charge from the sources indicated above.

Non-Solicitation

This press release is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed transaction and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of Andina, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Forward Looking Statements

This press release includes forward-looking statements that involve risks and uncertainties. Forward-looking statements are statements that are not historical facts. Such forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ from the forward-looking statements. These forward-looking statements and factors that may cause such differences include, without limitation, Andina’s and EMMAC’ inability to enter into a definitive agreement with respect to the proposed business combination transaction or to complete the transactions contemplated by the non-binding letter of intent; matters discovered by the parties as they complete their respective due diligence investigation of the other; the inability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things, the amount of cash available following any redemptions by Andina stockholders; the ability to meet NASDAQ’s listing standards following the consummation of the transactions contemplated by the proposed business combination; costs related to the proposed business combination; expectations with respect to future operating and financial performance and growth, including when EMMAC will become cash flow positive; the timing of the completion of the proposed business combination; EMMAC’ ability to execute its business plans and strategy and to receive regulatory approvals; and other risks and uncertainties indicated from time to time in filings with the SEC, including Andina’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019 under the heading “Risk Factors” and other documents of Andina filed, or to be filed, with the SEC. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Andina expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in Andina’s and EMMAC’ expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based.

For Andina Acquisition Corp. III

ICR

Investor Relations Contact:

Raphael Gross, (203) 682-8253

raphael.gross@icrinc.com

Media Relations Contacts:

Cory Ziskind, (646) 277-1232

cory.ziskind@icrinc.com

Keil Decker, (646) 677-1854

keil.decker@icrinc.com

For EMMAC Life Sciences Limited

Buchanan

Media Enquiries:

Henry Harrison-Topham / Jamie Hooper / Ariadna Peretz

Tel: +44 (0) 20 7466 5000

emmac@buchanan.uk.com

Forward Looking Statements

Certain statements made in this proxy supplement are “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. When used in this proxy supplement, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,” “propose” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements and factors that may cause such differences include, without limitation, Andina’s and EMMAC’s inability to enter into a definitive agreement with respect to the proposed business combination transaction or to complete the transactions contemplated by the non-binding letter of intent; matters discovered by each of the parties as they complete their respective due diligence investigation of the other; the inability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things, the amount of cash available following any redemptions by Andina shareholders; the ability to meet the listing standards of The Nasdaq Stock Market following the consummation of the transactions contemplated by the proposed business combination; costs related to the proposed business combination; expectations with respect to future operating and financial performance and growth, including when EMMAC will become cash flow positive; the timing of the completion of the proposed business combination; EMMAC’s ability to execute its business plans and strategy and to receive regulatory approvals; and other risks and uncertainties indicated from time to time in filings with the SEC, including Andina’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019 under the heading “Risk Factors” and other documents of Andina filed, or to be filed, with the SEC. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Andina expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in Andina’s and EMMAC’s expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based.

Participants in the Solicitation

Andina and its directors, executive officers and other members of their management and employees may be deemed to be participants in the solicitation of proxies of Andina shareholders in connection with the Extension and the potential transaction described herein under the rules of the SEC. Investors and security holders may obtain more detailed information regarding the names, affiliations and interests of Andina’s officers and directors in the Extension Proxy Statement, which was filed with the SEC on July 6, 2020 and will also be contained in the proxy statement/prospectus relating to the proposed transaction when it is filed with the SEC. These documents may be obtained free of charge from the sources indicated above.

Non-Solicitation

This disclosure herein is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed transaction and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of Andina, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Contact

Julio A. Torres

786-247-3449

jtorres@andacq.com

www.andacq.com