Networks until August 2021. From July 2013 to January 2018, Mr. Vogt served as President, Chief Executive Officer and a member of the Board of Directors of Imagine Communications, where he

directed the Company through revolutionary change as it evolved its core technology, including large-scale restructuring and rebranding and multiple technology acquisitions as he implemented a disruptive vision and growth strategy. Before joining

Imagine Communications, Mr. Vogt was President, Chief Executive Officer and a member of the Board of Directors of GENBAND (and its wholly owned subsidiaries, today known as Ribbon Communications), where he transformed the Company from a startup

to the industry’s global leader in voice over IP and real-time IP communications solutions. His professional career has also included leadership roles at Taqua (Tekelec), Lucent Technology (Nokia), Ascend Communications (Lucent), ADTRAN,

Motorola and IBM. Mr. Vogt received his B.S. in Economics and Computer Science from Saint Louis University. We believe Mr. Vogt is qualified to serve on the Company’s Board due to his extensive experience as a CEO of both public and

private companies.

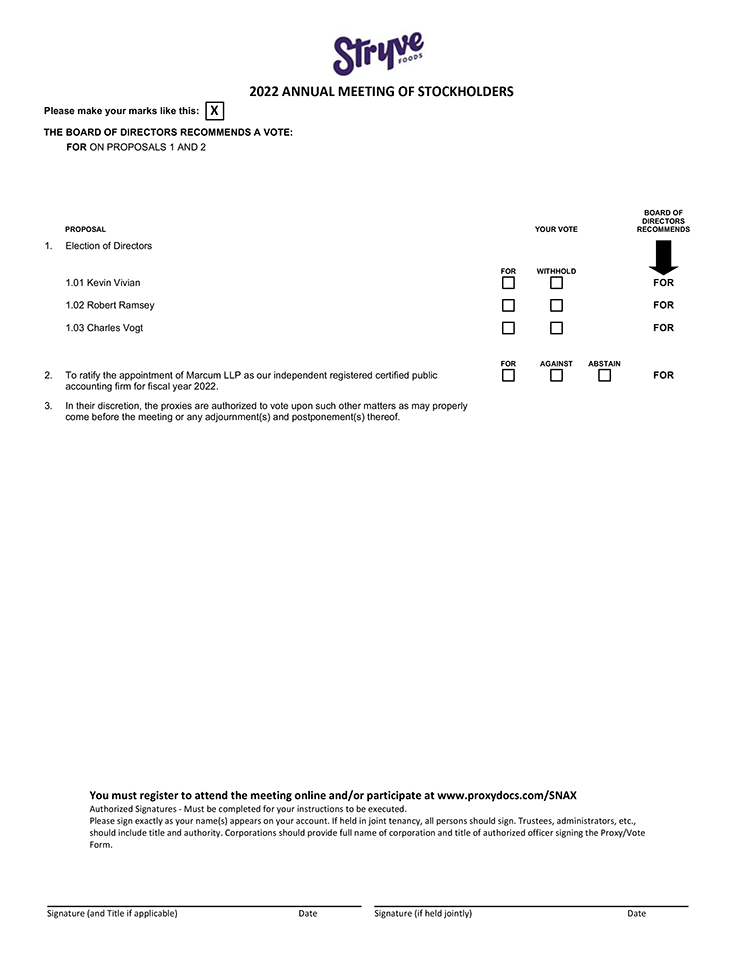

RECOMMENDATION OF THE BOARD:

The Board of Directors recommends a vote FOR each of the above director nominees.

Directors Continuing in Office

Class II Directors — Terms Expiring 2023

Mauricio Orellana (Age 57) has served as a member of the Board since November 2018 and previously served as Andina’s Chief

Operating Officer from September 2016 until the consummation of the Business Combination. Since 2013, Mr. Orellana has served as a financial consultant to companies in Latin America in the media, infrastructure and services sectors. From August

2015 to March 2018, Mr. Orellana served as Chief Financial Officer and a member of the board of directors of Andina Acquisition Corp. II (“Andina II”). From 2005 to 2013, Mr. Orellana was a Managing Director at Stephens Inc., a

private investment banking firm. From 2000 to 2005, Mr. Orellana was a Vice President and Managing Director at Cori Capital Partners, L.P., a financial services firm. Prior to this, he served as Investment Officer for Emerging Markets

Partnership and Inter-American Investment Corporation, each private investment firms. Mr. Orellana received a degree in electrical engineering from the Universidad Central de Venezuela and an M.B.A. from the Instituto de Education Superior de

Administracion. We believe that Mr. Orellana is well-qualified to serve as a member of the Board due to his contacts and prior experience with Andina II.

B. Luke Weil (Age 42) served as Andina’s Executive Chairman from July 2020 until the consummation of the

Business Combination and has continued to serve as a member of the Board after the consummation of the Business Combination. In October 2014, he founded the Long Island Marine Purification Initiative, a

non-profit foundation established to improve the water quality on Long Island, New York, and has served as its Chairman since such time. In November 2012, he also

co-founded Rios Nete, a medical clinic in the upper Amazon region of Peru. Mr. Weil served as Chief Executive Officer of Andina II from its inception in July 2015 until August 2015, served as a member of

its Board of Directors from its inception until its business combination with Lazy Days’ R.V. Center, Inc. (including as Non-Executive Chairman of the Board from February 2016 until the business

combination) and has served as a director of the newly formed public company, Lazydays Holdings, Inc., since the business combination. From 2008 to 2013, Mr. Weil was Vice President, International Business Development — Latin America for

Scientific Games Corporation, a supplier of technology-based products, systems and services to gaming markets worldwide. From January 2013 until its merger in December 2013, Mr. Weil served as Chief Executive Officer of Andina Acquisition Corp.

I (“Andina I”) and previously served as a member of its board from September 2011 until March 2012. From January 2004 to January 2006, Mr. Weil served as an associate of Business Strategies & Insight, a public affairs and

business consulting firm. From June 2002 to December 2004, Mr. Weil served as an analyst at Bear Stearns. Mr. Weil received a B.A. from Brown University and an M.B.A. from Columbia Business School. We believe that Mr. Weil is

well-qualified to serve as a member of the Board due to his contacts and prior experience with Andina I and Andina II.

Gregory S.

Christenson (Age 54) has served as a member of the Board since October 2021. Mr. Christenson is the Chief Financial Officer of Champion Petfoods and has served there since July 2019, where he leads finance, accounting,

tax, legal, treasury, and strategy as well as corporate development. He joined Champion Petfoods from Amplify Snack Brands, Inc. (which was purchased by Hershey in 2018). At Amplify, Mr. Christenson served as the Chief Financial Officer and

Executive Vice President, with responsibility for all public company financial and accounting aspects. Prior to his time at Amplify, he served as Chief Financial Officer of The WhiteWave Foods Company (which was purchased by Danone in 2017), as well

as the Chief Financial Officer, America Foods and Beverages and Senior Vice President of WhiteWave. While at WhiteWave, he was integral in driving sustained growth in the business, including the acquisition and integration of six companies, selling

the company to Danone, generating continued profit improvements, and leading the development and strengthening of its finance, accounting and IT functions. Prior to joining WhiteWave, Mr. Christenson was Chief Financial Officer and Vice

President of Oberto Brands from 2011 to June 2013 and was responsible for the finance, accounting, IT, procurement and risk management

8